All Categories

Featured

Table of Contents

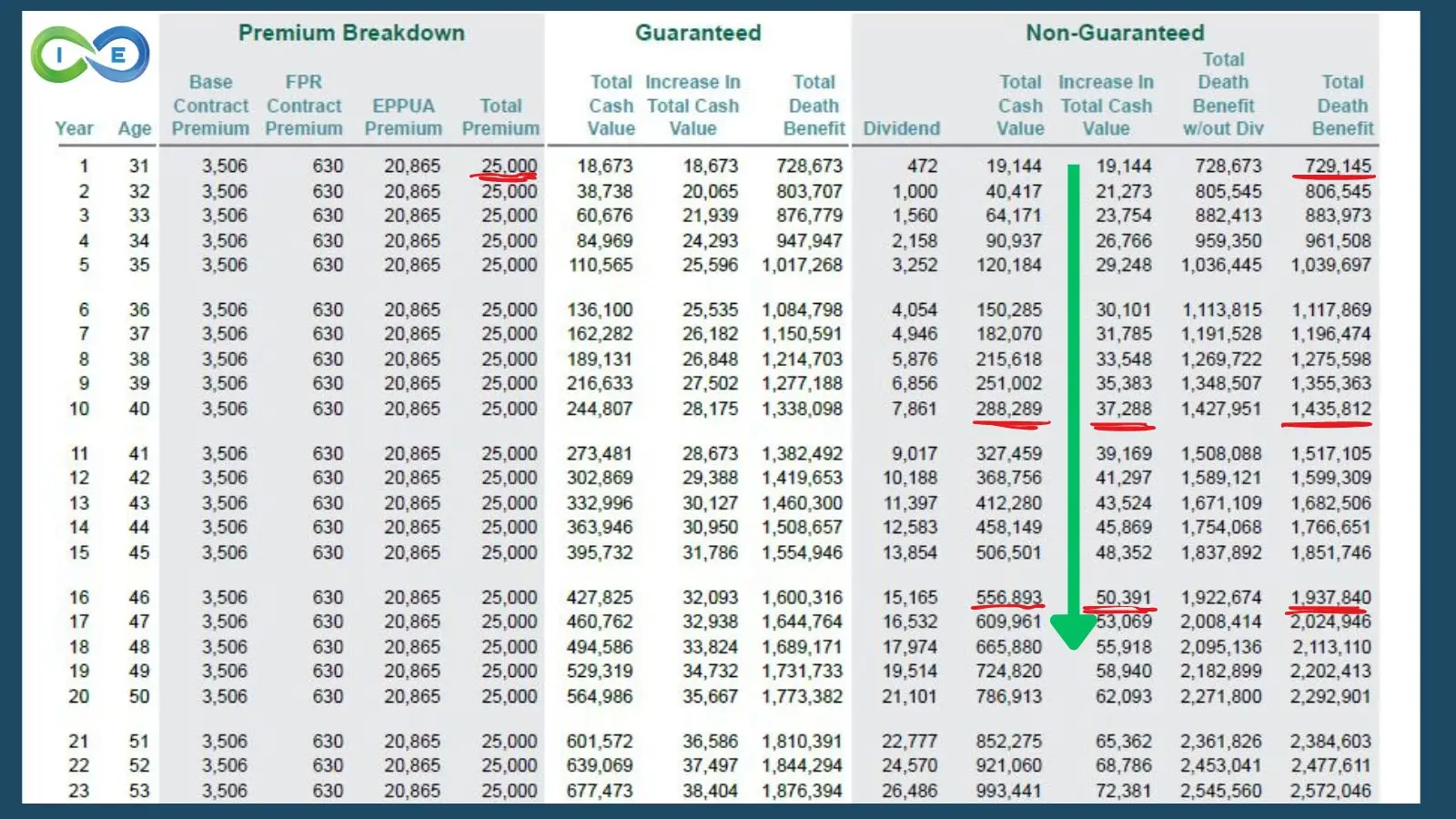

The are whole life insurance policy and universal life insurance. grows cash money value at a guaranteed rates of interest and also via non-guaranteed dividends. grows cash money worth at a taken care of or variable price, depending upon the insurance firm and policy terms. The money worth is not included in the fatality advantage. Cash worth is a function you capitalize on while active.

After 10 years, the cash value has actually grown to roughly $150,000. He takes out a tax-free lending of $50,000 to start a service with his brother. The policy funding interest rate is 6%. He pays back the finance over the next 5 years. Going this path, the passion he pays goes back into his policy's cash worth rather than a monetary institution.

Visualize never ever having to stress about financial institution loans or high interest rates once again. That's the power of boundless financial life insurance policy.

There's no collection finance term, and you have the liberty to determine on the payment routine, which can be as leisurely as repaying the lending at the time of death. This adaptability expands to the servicing of the financings, where you can opt for interest-only payments, keeping the loan balance flat and convenient.

Holding cash in an IUL fixed account being attributed interest can typically be much better than holding the money on deposit at a bank.: You've always imagined opening your own bakeshop. You can borrow from your IUL policy to cover the initial costs of leasing a space, acquiring devices, and employing personnel.

Bank On Yourself Concept

Individual car loans can be acquired from traditional financial institutions and credit report unions. Borrowing money on a credit card is typically very costly with yearly percentage prices of rate of interest (APR) frequently getting to 20% to 30% or more a year.

The tax therapy of policy lendings can differ dramatically relying on your country of house and the specific terms of your IUL plan. In some regions, such as North America, the United Arab Emirates, and Saudi Arabia, plan lendings are normally tax-free, offering a significant benefit. In other territories, there might be tax obligation implications to take into consideration, such as prospective tax obligations on the loan.

Term life insurance policy only provides a death advantage, with no cash value build-up. This implies there's no cash value to obtain versus. This post is authored by Carlton Crabbe, Ceo of Capital permanently, an expert in offering indexed universal life insurance accounts. The info offered in this short article is for academic and educational objectives only and ought to not be taken as financial or financial investment guidance.

Banking Concept

When you first listen to concerning the Infinite Financial Idea (IBC), your initial response may be: This sounds too excellent to be true. Probably you're skeptical and think Infinite Banking is a rip-off or scheme - what is infinite banking. We desire to set the record straight! The problem with the Infinite Banking Principle is not the principle yet those individuals using a negative critique of Infinite Banking as an idea.

As IBC Authorized Practitioners with the Nelson Nash Institute, we thought we would certainly answer some of the leading concerns individuals search for online when learning and comprehending whatever to do with the Infinite Banking Idea. What is Infinite Banking? Infinite Financial was developed by Nelson Nash in 2000 and fully explained with the publication of his publication Becoming Your Own Lender: Unlock the Infinite Financial Principle.

Cash Flow Banking Strategy

You believe you are coming out financially in advance because you pay no rate of interest, but you are not. With saving and paying money, you may not pay interest, yet you are using your money once; when you invest it, it's gone forever, and you provide up on the chance to gain life time substance interest on that cash.

Also banks utilize entire life insurance for the same objectives. The Canada Profits Company (CRA) even identifies the worth of taking part entire life insurance coverage as a special asset class utilized to create long-term equity securely and naturally and supply tax benefits outside the extent of typical financial investments.

Allan Roth Bank On Yourself

It permits you to produce riches by meeting the financial function in your very own life and the capability to self-finance major way of life acquisitions and expenditures without interrupting the compound interest. One of the simplest ways to think of an IBC-type getting involved whole life insurance policy plan is it is comparable to paying a home mortgage on a home.

With time, this would develop a "continuous compounding" impact. You get the image! When you borrow from your taking part whole life insurance plan, the cash money worth remains to grow undisturbed as if you never obtained from it to begin with. This is due to the fact that you are utilizing the cash money value and survivor benefit as collateral for a finance from the life insurance policy business or as security from a third-party loan provider (recognized as collateral loaning).

That's why it's crucial to deal with a Licensed Life insurance policy Broker accredited in Infinite Financial that frameworks your taking part whole life insurance coverage plan properly so you can avoid adverse tax obligation implications. Infinite Financial as a financial method is except every person. Below are some of the advantages and disadvantages of Infinite Financial you must seriously think about in making a decision whether to move onward.

Our preferred insurance service provider, Equitable Life of Canada, a common life insurance coverage business, concentrates on participating entire life insurance plans details to Infinite Banking. Also, in a common life insurance policy firm, policyholders are thought about business co-owners and receive a share of the divisible excess generated every year via dividends. We have a variety of carriers to choose from, such as Canada Life, Manulife and Sunlight Lifedepending on the needs of our clients.

Please also download our 5 Leading Inquiries to Ask A Boundless Financial Agent Before You Hire Them. For additional information concerning Infinite Financial check out: Please note: The material provided in this e-newsletter is for educational and/or educational objectives only. The details, point of views and/or views shared in this newsletter are those of the authors and not necessarily those of the supplier.

Infinite Banking Toolkit

The concept of Infinite Banking was produced by Nelson Nash in the 1980s. Nash was a money expert and follower of the Austrian school of economics, which supports that the worth of products aren't explicitly the result of conventional financial frameworks like supply and demand. Instead, people value money and products in a different way based upon their economic standing and needs.

One of the challenges of conventional financial, according to Nash, was high-interest prices on loans. As well numerous people, himself included, obtained right into monetary problem due to dependence on banking establishments.

Infinite Financial requires you to have your financial future. For goal-oriented people, it can be the ideal financial tool ever before. Below are the benefits of Infinite Financial: Perhaps the solitary most valuable element of Infinite Banking is that it enhances your cash money flow.

Dividend-paying whole life insurance is very reduced danger and provides you, the insurance policy holder, a great offer of control. The control that Infinite Banking uses can best be organized right into two categories: tax obligation benefits and property securities.

Entire life insurance policy policies are non-correlated possessions. This is why they function so well as the monetary foundation of Infinite Financial. No matter what happens in the marketplace (stock, realty, or otherwise), your insurance coverage plan retains its well worth. Way too many people are missing out on this essential volatility buffer that aids safeguard and grow wealth, instead splitting their money into two buckets: savings account and financial investments.

Market-based investments grow wide range much quicker however are subjected to market variations, making them naturally risky. What happens if there were a 3rd container that used safety yet likewise modest, surefire returns? Entire life insurance coverage is that third bucket. Not just is the price of return on your whole life insurance policy policy guaranteed, your survivor benefit and costs are also guaranteed.

Is Infinite Banking A Scam

This framework lines up flawlessly with the principles of the Perpetual Wealth Strategy. Infinite Banking attract those seeking higher financial control. Here are its primary benefits: Liquidity and availability: Policy finances provide prompt accessibility to funds without the limitations of traditional bank financings. Tax effectiveness: The cash money worth grows tax-deferred, and policy financings are tax-free, making it a tax-efficient device for building wealth.

Possession protection: In many states, the money worth of life insurance coverage is shielded from lenders, including an extra layer of financial safety and security. While Infinite Banking has its merits, it isn't a one-size-fits-all option, and it includes significant downsides. Right here's why it might not be the most effective technique: Infinite Banking typically requires detailed plan structuring, which can puzzle insurance holders.

Latest Posts

Become Your Own Bank, Hampton Author Advises In 'The ...

Nelson Nash Life Insurance

Become Your Own Bank. Infinite Banking